Prologue

Long ago in the kingdom of Literature, if you wished for your book to be published, you had to impress the royal court—publishers such as Penguin Random House and Macmillan—who gulped coffee, used red pens, and held your destiny. After submitting your manuscript, you had to wait half a year, and get a letter back that respectfully said: "Thanks, for your interest! But we'll pass."

These publishing giants weren't finicky—they were quite rich. Penguin Random House, in 2023, made €4.53 billion (approximately $4.92 billion), as reported by Bertelsmann's official financial report. Macmillan, meanwhile, under the Holtzbrinck umbrella, is said to have raked in more than $1.05 billion in 2021.

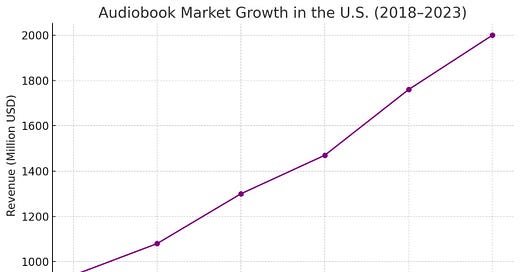

( Source-Statista)

But just as Macmillan was raking in its coins and Penguin was flapping its wings of literary clout, came a plot twist—social media. TikTok, Instagram, Twitter… overnight, readers weren't waiting for publishers to dictate what they needed to read—they were relying on a teenager with decent lighting and 30 seconds of BookTok drama.

So, what happens when centuries-long publishing culture collides with Gen Z's scroll-and-shop vibe? Grab your Kindle, your coffee, or that paperback you purchased for the 'gram’—because this is the tale of how books, business, and BookTok intersect. And it's sort of a wild ride.

Chapter- Beyond Paper

The publishing industry was all about classic paperbacks but they are being replaced by digital downloads and audiobooks. According to Statista's report (2024), the global book market is projected to aim for $130.5 billion by 2025, with digitalization accounting for more than 35% of the total. Due to their hands-free, multitasking appeal, audiobooks are the category with the fastest rate of growth among them. The U.S. audiobook market alone is worth $2 billion, with 13% year-over-year growth, according to the Audio Publishers Association (2023). This trend is being seized by companies like Audible, Spotify, and Google Play Books, which give consumers a way to "read" while working out, driving, or even doing the dishes. The format is growing less alternative and more popular, especially among Gen Z and millennials, as Spotify keeps adding audiobooks to its collection.

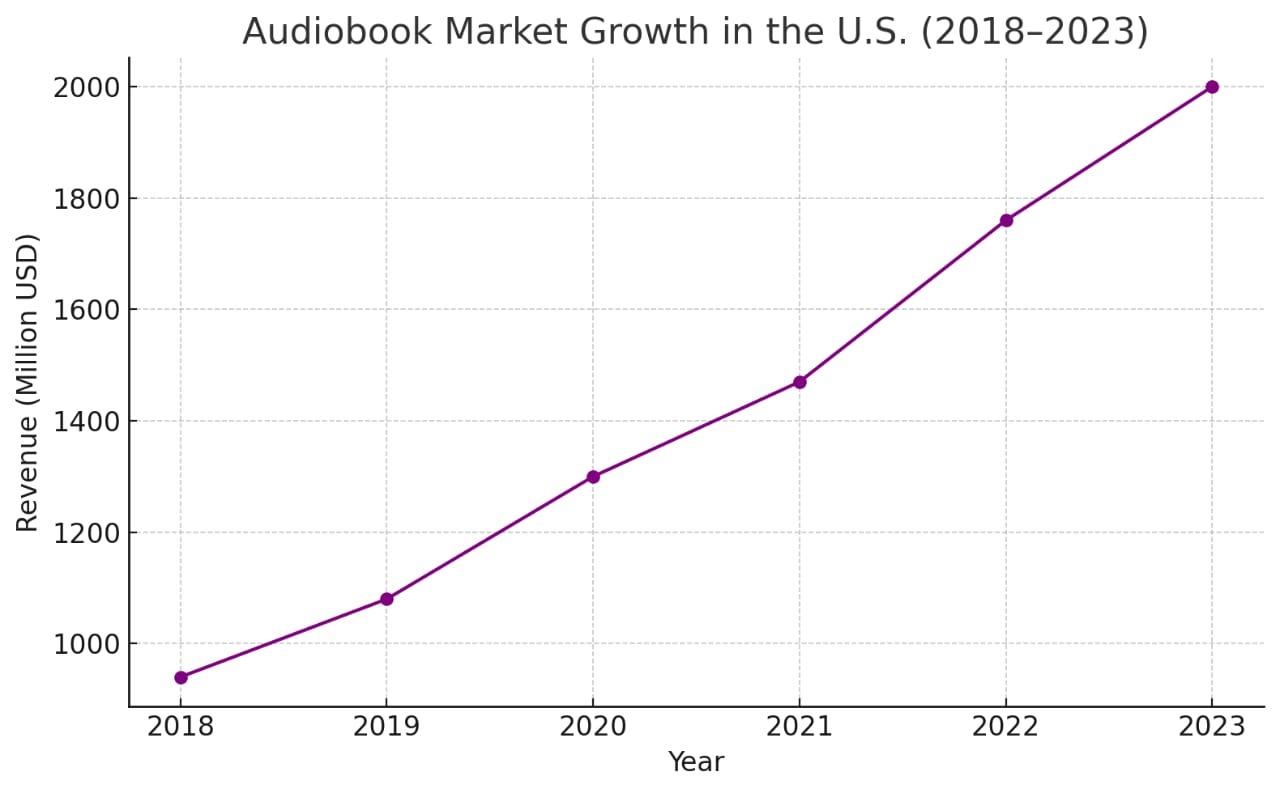

(source- Pew Research)

Paperbacks aren't extinct, however. In fact, they are still responsible for roughly 60 percent of book sales in the United States (NPD BookScan, 2023). A 10 per cent drop in physical sales may have been the result, but the physical experience of flipping pages, the smell of a new book and the beauty of bookshelves are still important. Print continues to be good to books that engage readers of traditional reading style, like romance and historical fiction. A 2023 Pew Research Centre poll split views: 42% prefer paperbacks, 33% e-books and 25% audiobooks. The three major drivers behind digital expansion are the forces of portability, on-demand access and cost effectiveness. Still, print is a sentimental favorite. So, in short, there is no longer one size fits all in the market.

Chapter: Who Owns the Bookshelf Now

From the dusty files of old-fashioned publishing to the algorithm-based digital age, the world of books is undergoing a twist worthy of a blockbuster novel. As social media hype engines, and online bookstores play puppeteer with algorithms- traditional publishers hold their coffee cups and say, "Back in my day…"

Traditional publishing does the editing, cover design, and distribution, but writers receive a small royalty slice- typically 10-25%. Self-publishing, on the other hand, allows authors to wear all the hats—from editor to marketer and keep 60-70% of the royalties.

BookTok has become an echo chamber, where best-selling opinions and genres ping-pong back and forth, muffling the new voices. At the same time, Amazon, Apple Books, and Kobo are the new masters, employing recommendation algorithms that determine which books get the limelight and which end up in digital obscurity. Physical bookstores are disappearing like a lost bookmark, leaving online retailers with virtual-monopoly strength to dictate prices and distribute books.

For publishers, it's adapt or die, they're spending money on data analysis and online marketing to keep up with the trends. While readers are the winners with more options than ever before, writers are subjected to a rollercoaster of uncertain royalties and cutthroat competition.

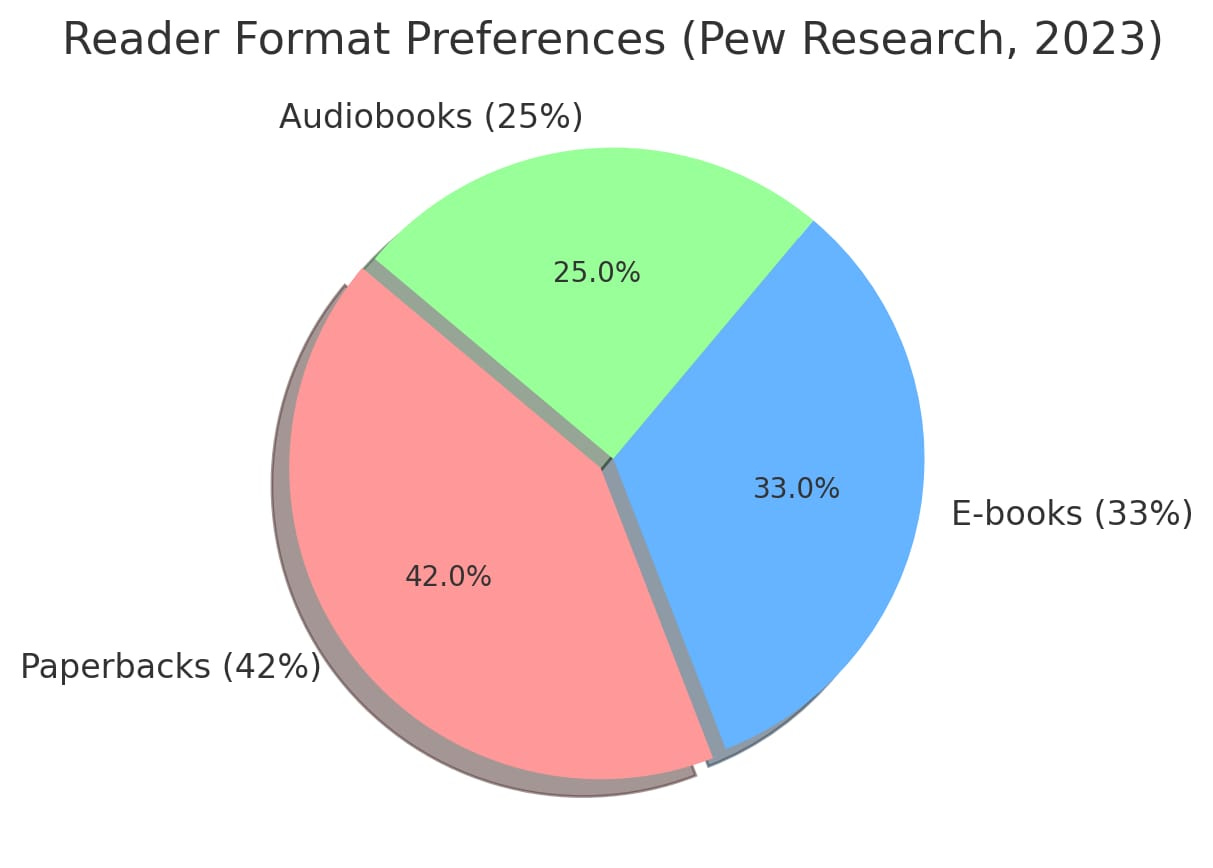

Chapter- The CoHo Effect

Colleen Hoover's current climb to the top is a case study of how social media transformed the publishing landscape. Authors used to depend on traditional marketing to introduce readers to their stories. Hoover shifted the paradigm by using social media such as TikTok. The traditional playing field of book marketing has now been replaced with BookTok, where dedicated readers created a phenomenon based on Hoover's *It Ends With Us*—two years after the novel was published. It is insane, the hashtag #colleenhoover has over 3 billion views.

(Source- Slate)

Hoover's distinct advantage is enlisting dedicated readers into her community, and in doing so has made them genuine advocates in the marketplace. It is a paradigmatic, meaningful, and thoughtful way to first create real success in publishing, and ensure a future for that success.

So, what does this tell us about publishing? To be a successful publishing author today is more than writing powerful stories; it is also about creating a community of dedicated supporters. Social media has become our current literary salon, where the enthusiastic reader acts like the curator for books. If authors can find these digital places and engage authentically then like Hoover they can create something special: relevance over time in an industry always chasing its next new cool thing.

Chapter: Fandoms, Feeds and Fiction

Publishers are betting big on fantasy, romance, dark academia, and YA are the genres and literary fiction is like that one manuscript that's been lingering in the slush pile for years—loved by a few, but not quite the cash cow.

BookTok, the TikTok book club, is the industry's new crystal ball. It's where publishers go to predict the next big thing, and authors pray their books will go viral. Remember when Fourth Wing and Happy Place broke the internet? Adult fiction sales soared by 25%, and suddenly every editor was scrambling to find the next viral hit.

Online platforms such as Wattpad and Webtoon are now the testing grounds for writers. It's almost a literary boot camp where writers can hone their skills, establish a following, and perhaps-just perhaps-get noticed by a conventional publisher. Webtoons? They're estimated to increase from $3.7 billion in 2021 to a whopping $56.1 billion by 2030. That's somehow even longer than a wheel of time book!

And then there are the multimedia adaptations-the book trade equivalent of a golden ticket. Films and shows based on books earn 44% more at the UK box office and 53% more globally than commissioned scripts. So, if you're a writer who wants to be a star, forget writing the next Great Gatsby. Instead, mix some fantasy with romance, a pinch of dark academia, and voilà! You could be on the bestseller list. And even if you don't end up in print, your work can still do wonderfully in the booming audiobook industry. With companies like Audible and Scribd, your epic fantasy romance can find its way into listeners' ears around the globe, even if it never makes it to the stores.

Chapter: Shuffle > Storytime

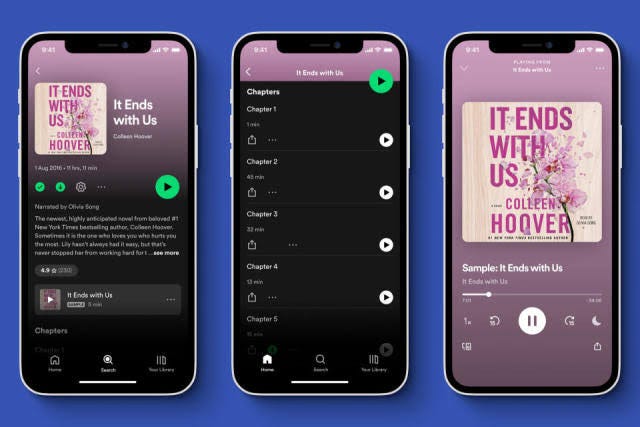

Spotify's foray into audiobooks is not just a chapter – it represents a full-blown plot twist in the publishing category. Offering 15 free hours of audiobooks for its premium users, Spotify has encouraged its 213 million subscribers to trade in playlists for plotlines, marking a direct assault on Audible's dominance. The early signs are encouraging: while it took weeks in the UK/Australia, nearly a third of titles were sampled with overall listening hours up over 35% year on year.

Spotify's freemium model has lowered the barrier for entry and could easily convert casual listeners to premium subscribers and then on to paid Audiobook subscriptions. Spotify encourages users from the platform's algorithmic recommendations, and if listeners are not only exposed to audiobooks but encouraged to listen from music to audiobooks, the potential for discovery expands.

(Source- Engadget)

Regardless, Spotify completes its audio ecosystem; one-stop shopping for music, music podcasts, and even audiobooks. If users discover audiobooks like they have playlists, Spotify could transform publishing, opening up a regular listening opportunity. Will listeners stay for the epilogue or hit the next track? Either way, publishing must grid itself for a new chapter.

Chapter: Page Turners to Page Earners

The emergence of "all-you-can-read" sites such as Kindle Unlimited, Scribd, and Audible Plus is revolutionizing publishing more quickly than a twist in a thriller. These subscription plans have made readers literary buffet patrons, consuming a rate of nine books a month on Kindle Unlimited alone, all for one set monthly fee that is easier on the budget (and much less cringe-worthy than having to explain your 37 unread paperbacks).

The Kindle Unlimited buffet might be good for readers, but authors will find the per-page royalty system a fiscal enigma. The per-page royalty structure pays writers for only the pages read by a reader and not the entire book. So, reader engagement becomes a key driving force for the authors. Though these services chip away at the sales of traditional books, they also open the doors to a gigantic digital library with more than a million books on Scribd, 11,000 audiobooks on Audible Plus, making it a competitive playground for publishers and self-published authors alike.

While subscription services offer authors new ways to monetize engagement, piracy threatens to undercut their earnings entirely. The same digital landscape that empowers readers with unlimited access also fuels the illegal distribution of books. For writers, the challenge isn’t just competing in a crowded marketplace—it’s protecting their work from being stolen before it even reaches their audience.

Chapter: Stolen Stories

Online piracy lurks in the digital realm, directly taking billions from the publishing industry every year. In India, it can be upwards of ₹400 crores a year and independent authors are the hardest hit - unauthorized downloads of their work can cause their income to be reduced by close to 30% and it threatens their passion with drudgery!

Where's piracy happening? In the usual places, like file-hosting sites such as 4shared and RapidShare, shadow libraries, and chat platforms leaning into the public's gusto for free reading - particularly overpriced academic and professional books. Genuine sales drop, new creative content stalls, and almost 1 out of 5 books sold in India is an unauthorized copy.

Publishers are looking for common sense remedies, copyright infringement strategies through Digital Rights Management (DRM), take down blitzes, and litigation. However, the pirates are too nimble. The real solution is more sophisticated technology, affordable legal alternatives, and a slight bit of reader holistic education.

Epilogue

The publishing business's narrative no longer presents a linear trajectory—it's a choose-your-own-adventure, where gatekeepers are overthrown by virality, algorithms create serendipity, and the very concept of a "book" gets redefined to encompass TikTok overviews and AI-narrated serials. But beneath the upheaval is an undercurrent of tension: for each of the opportunities (self-publishing riches, subscription-model bonanzas), there's a counterpoint (piracy's drain, the struggle to remain visible in a flooded market).

What doesn't change is the reader's appetite for stories—now, though, they want them faster, cheaper, and in infinite variation. The victors won't be those holding on to ink-and-paper sentimentality, but those who view books as living, breathing entities: flexible, communal, and willing to remix convention. The final page? It's empty, waiting for the next disruptor to write on it—or perhaps just click "Publish."

References

https://www.statista.com/statistics/272186/revenue-of-the-publishing-group-random-house-since-2005/

https://wordsrated.com/macmillan-publishers-sales-statistics/

https://www.thebookseller.com/news/prh-saw-7-sales-rise-in-2023-but-profits-were-flat

https://wordsrated.com/macmillan-publishers-sales-statistics/

ErinNickCarlyBridie. (2018, April 25). Social media and the publishing industry - ErinNickCarlyBridie - medium. Medium. https://medium.com/@nicholascurry/case-study-new-media-and-the-publishing-industry-11348b307689

Christian, A. (2023, December 8). Why Spotify is betting big on the booming audiobooks industry. https://www.bbc.com/worklife/article/20231103-why-spotify-is-betting-big-on-the-booming-audiobooks-industry

. (2023, October 4). Spotify’s Audiobooks Push: Wall Street Dissects How It Differs From Its Podcast Initiative. The Hollywood Reporter. https://www.hollywoodreporter.com/business/business-news/spotify-audiobooks-stock-analysts-earnings-subscribers-audible-1235608302/

Insightful