Introduction

As global trade reels from tariffs, pandemics, and shifting alliances, one question stands out: Can India step up as the next supply chain superpower? With U.S.-China trade declining, Apple producing billions worth of iPhones in India, and FTAs unlocking new markets, the article explores how India is positioning itself in a high-stakes global reshuffle—and whether it can overcome the bottlenecks in its path.

Once upon a time there was a tariff war which led us to a global supply chain's downfall. The efficient global logistics system had an internal breakdown, almost like hacking up a hairball. Directly attributable to the US-China tensions, the not-so-great coronavirus pandemic, and the world’s obsession with “strategic autonomy” - and voila - The system coughs out shipping containers. The US imports from China nosedived over 15% from 2018 to 2024 as companies scrambled for new trading partners to boost business - “China + 1” and “friendshoring” were born.

It isn’t an unrealistic expectation for India to now capitalize on the economic rivalry and assume a key role in the shifting global supply chains due to the ongoing game of economic musical chairs. India tops the list with an impressive GDP growth estimate of 6.5% for 2024-25. India is now 10% cheaper than key competitors when it comes to US-bound goods, and that’s even *before* imposing tariffs. Furthermore, the tech sector in India reached new heights when the country exported more in services than Saudi Arabia exported in oil - “high-octane” achievement.

India is Cabinet-approved and set to receive billions in infrastructure spending, the zooming electronics sector has also attracted global attention.

Global Supply Chain Disruptions: The Fallout of Tariffs and Pandemics

The US Census Bureau says that US imports from China fell by 15.2% between 2018 and 2024. Who is to blame? A trade war that put taxes on more than $350 billion worth of Chinese goods, making them less affordable and forcing many businesses to rethink their "everything-from-China" strategy (US Census Bureau, 2024). If you relied on one company for all of your food and then found out that they had suddenly raised prices and delayed deliveries, what would you do? That's pretty much what happened to global supply networks.

Then COVID-19 showed up uninvited, like a party crasher that everyone had to deal with. The pandemic showed how weak and tightly wound these supply chains were, with factories closing and shipping delays causing problems all over the world. "China+1" was no longer just a catchy phrase; it was the new way to stay alive. To spread risk and keep goods moving, businesses began to look to countries other than China, such as India, Vietnam, and Mexico (OECD, 2022).

India, while observing everything from a distance, took its chance in the middle of the chaos with the goal to increase the manufacturing sector's share of GDP from 17% in 2022 to a healthy 25% by 2025. This will be possible thanks to government initiatives like the Production Linked Incentive (PLI) scheme and the "Make in India" campaign. It's like going from a home-cooked meal to a Michelin-star banquet in just a few years. Free trade agreements with Australia and the UAE are also helping by lowering the cost of raw materials and making exports easier. This is similar to getting fast passes at the airport security queue (India-Australia FTA, 2022).

India's economy is doing more than just talking, by showing consistent results. In FY 2024-25, its GDP grew by 6.5%, and in the fourth quarter alone, it grew by 7.4%. According to the Press Information Bureau, Government of India, 2025, that's a lot of power, especially in fields like construction and manufacturing. India also beat Saudi Arabia in service exports in 2022, showing that countries with a lot of oil don't always have the most power in global trade (UNCTAD, 2023). Who would have thought that software and services could be better than barrels of oil?

Indian businesses are following the lead of American businesses and changing their inventory management from "just-in-time" to "just-in-case." It's not good when parts run out in a supply chain, just like when you run out of coffee on a Monday morning. They're also improving their relationships with suppliers, looking for backup sources, and using digital technology to see where goods are at all times. It's like putting a GPS tracker on every package so that there are no surprise detours or lost packages (World Economic Forum, 2023).

Apple’s Manufacturing Pivot to India Amid U.S. - China Trade War

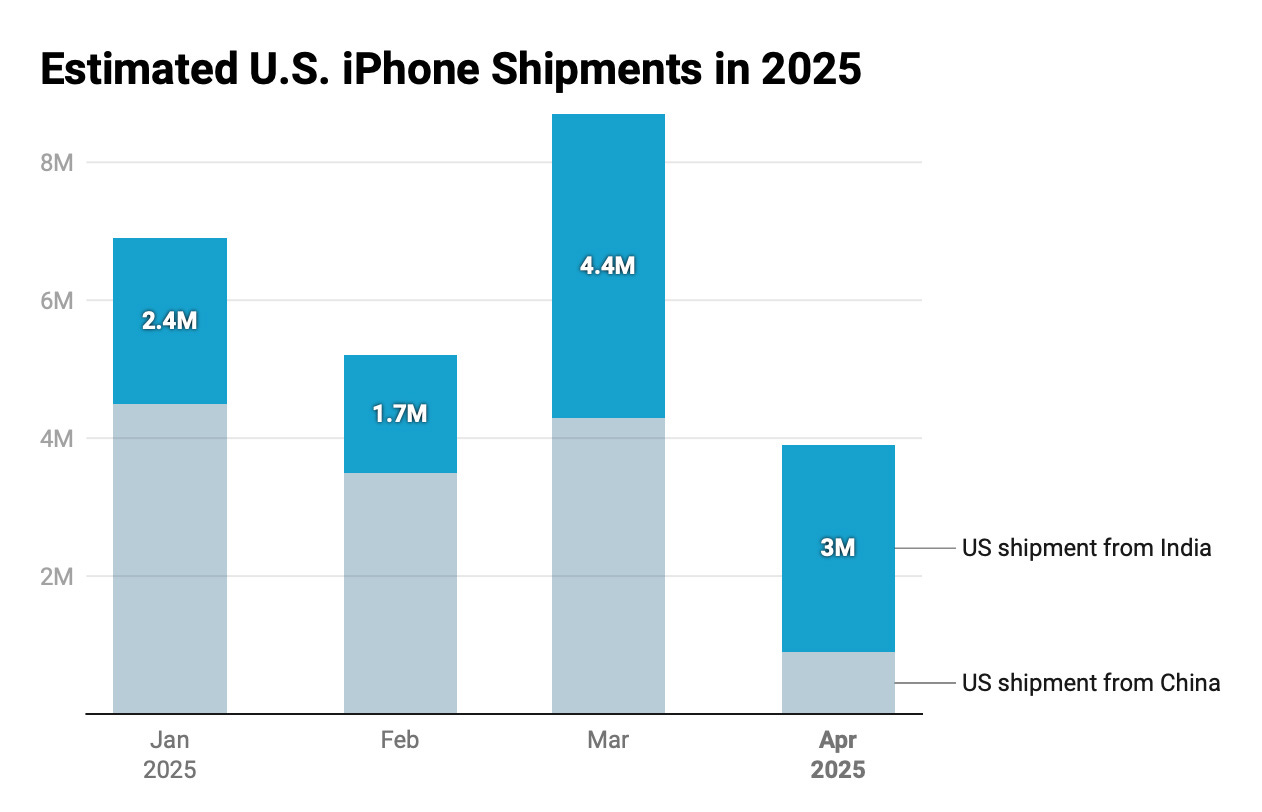

With the onset of the epidemic, geopolitical tensions and rising tariffs on Chinese goods, major tech giants are shifting their production away from China and diversifying the supply chain. Amid the U.S.- China tariff fiasco this year, with tariff rates on China still above 30%, the Cupertino giant Apple.Inc found itself in an existential supply chain crisis. The flip side though is that India takes centre stage as Apple ramps up Iphone Production, assembling $22 billion worth of Iphones in India, nearly 60% over the previous year. With the looming threat of tariffs, Apple hit the panic button- expediting shipments from India to the U.S. in an attempt to preempt reciprocal taxes. In April 2025 alone, Apple exported 3 million iPhones from India to the U.S., a 76% YoY increase. During the same period, iPhone shipments from China plummeted 76%. India’s massive smartphone export drive, led by Apple’s contract manufacturers- Foxconn, Tata and Pegatron is testimonial of its rising capabilities. Government- led initiatives in India encompassing The Make In India Program, The PMP and The PLI schemes have played an instrumental role in this transformation. Things had just started to look uphill when president Trump in a meeting, warned Apple alluding to slap a 25% import duty on sales of Indian-assembled iPhone in the U.S. However the company’s CEO Tim Cook at the time seemed steadfast in his goal to diversify production beyond China with India as a major producer.

Source: based on data from market research firm Omdia (formerly Canalys)

Will India remain the ‘ Apple’ of Apple's eyes or will Trump's pressure on Apple jeopardize India’s rising ambition? It seems, given the lack of supply chain, skilled labor, and high cost of manufacturing in the US, rendering the cost of an iPhone 8 to 10 times more, compared with India, Apple has little choice but to look east. Manufacturing in the U.S. ? Only if customers are willing to pay $10,000 for the privilege of ‘ Made In America’ engraved on the box.

Opportunities, Challenges and the Road Ahead

India stands at the center of a global supply chain reshuffle, and opportunities are pouring in, particularly in the form of increased FDI, sector specific booms, and wider access to export markets. India has made significant strides in advancing its global trade agenda through a series of strategic Free Trade Agreements aimed at reshaping the nation’s economic landscape. Deals with U.S., UK and EFTA countries bolster India’s future as a leading global trader. What stands out is the scale of these investment commitments. The EFTA agreement includes a groundbreaking $100 billion investment commitment over 15 years, potentially rippling a $500 billion investment boom. Meanwhile, the UK-India FTA will slash tariffs on everything from textiles to tech services.

As India races ahead, it is also navigating a maze of fresh challenges, think complex regulations, infrastructure bottlenecks, and stiff global competition. Logistics costs are still higher in India than the global average. Port congestion, inconsistent railway connectivity, and underdeveloped industrial corridors continue to limit scalability. With the west’s inward looking policies, fear of reciprocal taxes, and geopolitical headwinds India has to walk a tightrope between competing with China, engaging with Russia, and aligning with the west. India’s continued dependence on China for imports of semiconductor components, APIs and other goods is also a matter of growing concern.

If India can maintain this delicate balance of reform, investment, and diplomacy, it has the potential to evolve from a rising star into a global manufacturing powerhouse.

Conclusion

The global trade situation has undergone a displacement that has caused countries and businesses to rethink familiar supply chain patterns. The move is attributed to trade wars which were driven by tariffs and supply disruptions which were prompted by pandemics. Not only have Indian companies emerged intact, they have quickly adapted too. By observing how American companies responded to chaos through resilience-building, diversification, and quick adoption of new technology, India has embarked on its reimagination of the supply chain. With PLI, free trade agreements, and initiatives like "Make in India", the country has become a more cost-efficient, politically stable, and technologically competent option in the global value chain. Examples of substantive changes can be found in Apple's expansion of manufacturing in India, and Walmart's multibillion-dollar sourcing efforts. The road ahead is full of opportunities but equally risky.

References

https://www.pib.gov.in/PressReleasePage.aspx?PRID=2132688&

https://oec.world/en/profile/bilateral-country/ind/partner/usa?

https://www.census.gov/foreign-trade/balance/c5700.html

https://www.pib.gov.in/PressReleasePage.aspx?PRID=2132688

https://www.sciencedirect.com/science/article/abs/pii/S0022199624001387?