Fintech Frenzy: The Joy and Peril of Digital Dollars

Fintech: Your Financial Ally or Just Another Temptation to Splurge?

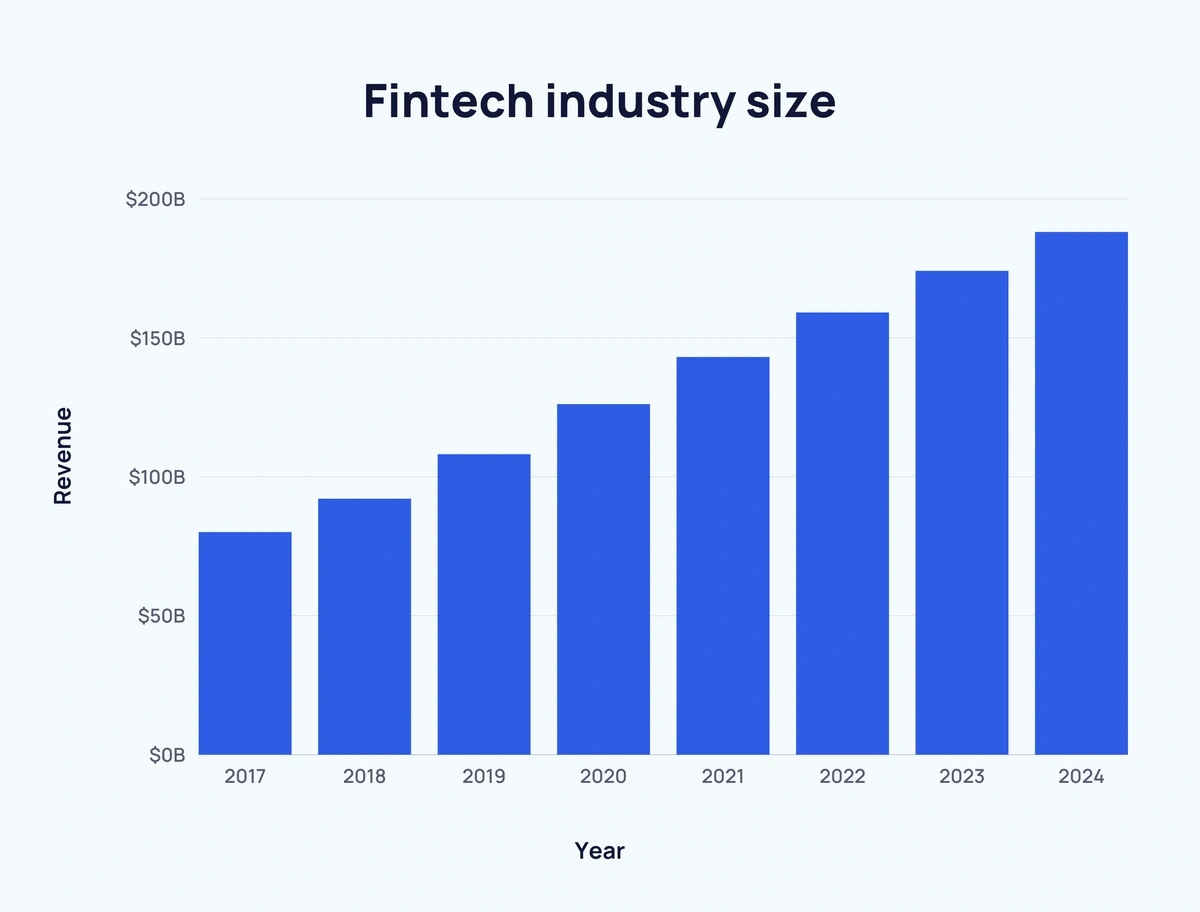

Thank you, fintech, for making life easier—and leaving us a little more broke. Between those sneaky price hikes after revisiting products and UPI working its magic, we’re living the dream (or nightmare). Just ask my friend, who went Diwali shopping at Kamla Nagar and now feels a little bankrupt. Fintech’s been evolving right before our eyes, from online banking to seamless UPI payments. It’s everywhere—helping us manage finances, spend too much, and wonder where our money went. And with fintech app adoption up 38% since 2020, it seems we’re all still hooked on this love-hate relationship with our digital wallets.

INTRODUCTION

Finance and tech teamed up and gave us fintech—think of it as the superhero disrupting traditional banking. Shockingly, the term "fintech" existed even before ATMs! From basic online banking to AI, blockchain, and Web 3.0, fintech has exploded, now grabbing 2% of global financial services revenue. India is leading the way with an 87% adoption rate, and by 2030, its fintech sector could reach $1 trillion in assets. It’s fast, it’s smart, and it’s changing how we handle money—sometimes before we even realise it!

The Spark

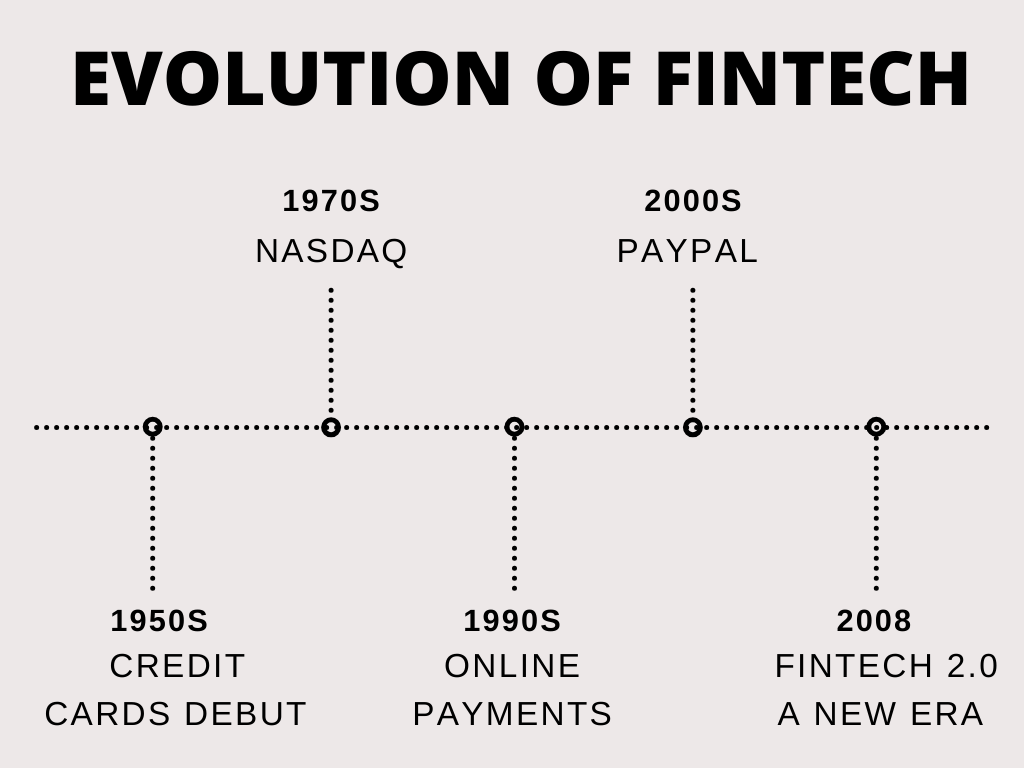

Once upon a time, moving money with a screen tap seemed as futuristic as flying cars. But thanks to early tech minds like Charles Babbage and Alan Turing, their groundwork sparked the rise of fintech. The first electronic money transfer in 1918, using Morse code and transatlantic cables, connected 12 U.S. federal banks. That moment was the birth of fintech as we know it today—though back then, "fintech" wasn’t even a thing.

1950s-2000s:

Fast forward to the mid-20th century: credit cards made their debut in the '50s. The real digital shift began with the installation of the first ATM by Barclays in 1967. The '70s gave us more than bell-bottoms and disco—it also introduced CHIPS - Clearing House Interbank Payments System (for faster interbank payments) and SWIFT (Society for Worldwide Interbank Financial Telecommunications), revolutionising how banks communicated across borders. The '70s saw the rise of NASDAQ, the first digital stock exchange. The '80s introduced smarter banking with mainframe computers, while the '90s brought online banking. In 1999, PayPal entered the scene, offering a glimpse of digital transactions. However, it was the 2008 global financial crisis that truly propelled fintech forward, as public confidence in traditional banks was severely shaken, paving the way for fintech to take centre stage.

2008 and Beyond:

After the crisis, banks felt shaky, but fintech soared. The crisis highlighted that while banking was essential, banks were not, working as a disruptive creator, prompting tech firms to enter the sector as "techfin." Bitcoin, born in 2009, kicked off the crypto revolution, while smartphones became our go-to banking devices. Startups emerged with innovative financial solutions, giving birth to "neo-banks" and a fintech industry that continues to grow and reshape how we manage money.

Part II: THE IGNITION

The Great Recession: A Catalyst for Change

Ah, 2008—the year the financial world fell apart and took everyone down with it. You probably remember it as the time when Wall Street had a meltdown, and people suddenly realised that "too big to fail" didn’t mean much when the government had to bail out the banks. As you can guess, trust in the big banks hit rock bottom. People lost jobs, homes, and in some cases, their sanity.

But while everyone was picking up the pieces, something interesting happened: innovation. With trust in traditional financial systems plummeting and lots of talent suddenly out of work, many savvy individuals said, “Hey, we can do better!” Enter: FinTech.

Fintech exploded as techies started creating easier, faster, and—most importantly—non-bank ways to move and manage money. Peer-to-peer lending took off, allowing regular people to lend to each other without needing a bank as the middleman. Meanwhile, Bitcoin was quietly born, along with other cryptocurrencies, leading people to wonder if we even needed banks at all. (Spoiler: We still kind of do, but they’re getting a run for their money).

And let’s not forget the smartphone boom. With the iPhone revolutionising the way we accessed everything, banks and startups alike jumped on the chance to build mobile banking apps. Fast forward, and suddenly, we could do more on our phones than we ever could with a bank teller.

Mobile Money Madness: A Global Phenomenon

If the financial crisis was the spark, mobile money was the wildfire that spread globally. Everywhere you looked, people were suddenly whipping out their phones to pay for coffee, send money, or even fund a business. Mobile payments transformed the landscape, particularly in areas where banking services were scarce.

In countries like China, India, and across Africa, where traditional banking services weren't always easily accessible, mobile payments opened up new opportunities. Individuals and small businesses began making payments, transferring money, and accessing financial tools—all through mobile technology. This revolutionised financial inclusion, allowing more people to engage with the economy in ways that were previously out of reach.

For example, think of a regular online shopper: She fills her cart, goes to check out, and boom—there’s the dreaded “create an account” page. Forty-two percent of us will abandon our cart right there. (Who wants another password to remember?) But fintech swoops in, offering one-click checkouts, mobile-optimised payment pages, and more ways to pay than you can shake a stick at. Consumers want speed and simplicity, and fintech delivers.

The future of finance could very well lie in our pockets—or, more accurately, in the applications we install. From peer-to-peer lending to mobile transactions, fintech is firmly established, disrupting traditional banking and enabling individuals globally. It’s a brave new world of money—one that’s fast, tech-savvy, and fun. Well, fun if you like watching your bank account squirm.

Part III: THE FUEL

Blockchain: A Game-Changer

Let’s face it—when you hear "blockchain," your mind probably goes straight to Bitcoin, or maybe you picture Elon Musk tweeting about Dogecoin. But blockchain is way more than just the engine behind quirky cryptocurrencies. Think of it as a super-secure locker for all your digital transactions, where everything is encrypted and nothing slips through the cracks. It’s a kind of digital bookkeeping that ensures you can trace every penny, minus the sketchy middlemen. But that's not all of its benefits; utilising blockchain screams “GO GREEN.”

Beyond crypto, blockchain is fueling innovations like smart contracts in Decentralised Finance (DeFi), cutting out the middleman entirely. Governments are getting in on the action too, with countries like India and China dabbling in Central Bank Digital Currencies (CBDCs). Oh, and did we mention it’s even helping the planet? By making green bonds more accessible, blockchain’s pushing sustainable finance into the mainstream. Imagine saving the world one tokenized bond at a time. Pretty cool, right?

AI and ML: Intelligent Finance

Artificial intelligence (AI) and machine learning (ML) are like the nerdy best friends of fintech, quietly running the numbers and saving us from fraud. These technologies can sift through mountains of data faster than you can say “cryptocurrency,” flagging any shady transactions or bad loans that might trip up the financial system.

AI’s not just for banks though—it’s making life easier for you too. Ever been shopping online, and suddenly your bank sends you a message asking if it's really you? That’s AI, catching fraud before it happens. It also helps lenders make smarter decisions about who to approve for loans, meaning more people (hello millennials!) can finally get that credit they deserve. Organisations throughout the fintech sector are leveraging AI into their risk management practices, for forecasting and accurate credit scoring which can help prevent another 2008-style financial crisis. However, this forecasting isn’t airtight, it comes with a huge cost in case of blunders and is often compared to ‘playing god’ by the critics.

UPI: The National Hero

Unified Payments Interface (UPI) developed by the National Payments Corporation of India (NPCI) is a mobile based- real time payments system that has revolutionised the digital payments field in India by enabling interoperability among different banks in an attempt to bring all digital transactions under a single umbrella.

Basically, UPI (Unified Payments Interface) has turned into a superhero—no cape required. Need to pay for groceries, split a bill with a friend, or send some money to your rickshaw driver? UPI’s got you. It’s basically made QR codes the new best friend of every Indian shopper, and it’s spreading globally. Consider the 2023 partnership between Singapore and India, which enabled real-time cross-border payments. No extra fees, no waiting days for money to clear. It's instant, secure, and ridiculously convenient.

Part IV: THE FUTURE FLAME

Fintech 2.0: A New Era

Welcome to Fintech 2.0, where your financial future is literally at your fingertips—no more waiting in line at a stuffy bank! Remember when cash machines took decades to emerge? Now, we have apps updating faster than your friend’s Instagram feed! Innovations like open banking, embedded finance, and decentralised finance (DeFi) are paving the way for seamless financial experiences.

Imagine using one app to manage your bank account, secure a loan, and invest in crypto—all in a few taps. It’s projected that by 2025, over 50% of consumers will prefer digital wallets for daily transactions. Just picture grabbing your morning coffee and scanning a QR code instead of fumbling for cash!

But let’s not get too carried away. The fintech industry faces regulatory hurdles and cybersecurity risks, lurking like that pesky mosquito at a summer barbecue. Yet, with every challenge comes opportunity.

As we navigate this evolving landscape, putting the customer experience front and centre isn’t just smart—it’s vital. In conclusion, the future of fintech looks promising, simplifying money management significantly and paving the way for an exciting journey that will keep our wallets engaged.

References:

Pangestu, M. E. (2024, March 16). Fintech and Financial Services: Delivering for development. World Bank Blogs. https://blogs.worldbank.org/en/voices/fintech-and-financial-services-delivering-development

Pangestu, M. E. (2024, March 16). Fintech and Financial Services: Delivering for development. World Bank Blogs. https://blogs.worldbank.org/en/voices/fintech-and-financial-services-delivering-development

Anan, L., Isaza, D. C., Figueiredo, F., Flötotto, M., Jerenz, A., Krivkovich, A., Nadeau, M., Olanrewaju, T., Partner, A., & Vassallo, A. (2023). Fintechs: A new paradigm of growth. In McKinsey & Company. https://www.mckinsey.com/industries/financial-services/our-insights/fintechs-a-new-paradigm-of-growth

Blockchain in fintech: use cases, challenges, and solutions. (n.d.). https://ventionteams.com/fintech/blockchain/guide

Benefits and use cases for artificial intelligence (AI) and machine learning (ML) in FinTech. (2024, September 4). HQSoftware. https://hqsoftwarelab.com/blog/benefits-use-cases-ml-ai-in-fintech/