Until very recently, it was just large companies enjoying financial frenzy, backed with the resources to afford full-time CFOs, target financial experts, and spreading back end operations. Today, this model is being fundamentally reimagined. With the upsurge in the freelance financial services and fractional CFOs, financial leadership is no longer a niche crack, it’s accessible, acute, and non-negotiable for startups and developing businesses.

Jumping across the boss areas: Traditional to Freelance

Traditional financing lags behind because of rigid structures, hierarchy based teams, complex decision making flow and a bundle of set services with gigantic money withdrawal and low acclimatization. Meanwhile, our cool, new age, everyone’s favorite, freelance finance model offers specialized, on-demand expertise, tailored precisely to the needs of a business at any stage of growth.

According to a 2023 report by McKinsey & Company, over 36% of finance executives in mid-sized companies reported outsourcing critical finance functions like FP&A, risk management, and compliance to freelancers or part-time experts. Why? Because it allows businesses to remain lean while scaling with precision.

Meet the Fractional CFO: The Startup’s New Best Friend

Hear the loud thud? That’s our Fractional CFO, a professional who operates like a CFO, but contractually or on a project basis. They not only keep your pockets heavier but strategically help companies with financial forecasting, client handling and investor communication, M&A strategy, fundraising, and cash flow management.

India is catching up with the boom fast. Blume Ventures, one of India’s prominent early-stage VCs, reported that more than 60% of its portfolio startups work with fractional CFOs during their growth phase, particularly when preparing for Series A and B rounds.

These professionals bring:

Fractional pay-cheques (pay only for what you need)

Undivided attention to targeted goals

Amiable contracts and hours

Better outcomes at a fraction of the cost

According to Toptal, the global freelance platform, demand for freelance finance experts grew by 68% in 2023, especially among SaaS and D2C businesses.

Source: Flux Academy

Quick, Smooth and Herculean:

Let’s consider a Series-A SaaS startup in Bengaluru. With limited runway and a lean team, hiring a full-time CFO wasn't feasible. Instead, the startup engaged a freelance finance strategist from a global platform like GrowTal or FlexTal. Within six months, the company streamlined its burn rate, revamped its pricing model, and raised an additional $3 million—all without onboarding a full-time executive.

Similarly, retail SMEs in Tier-2 cities are increasingly turning to freelance finance teams for GST compliance, dynamic MIS reporting, and cash flow optimization—areas previously out of reach due to budget constraints.

Why This Model Works

Agility: Freelancers are quickly absorbing to evolving business needs. Whether it's a month-long fund seeking sprint or a 2-week audit, they’re easily available.

Affordability: Hiring a full-time CFO in India can cost ₹40–60 lakhs annually. A fractional CFO? Often less than ₹1 lakh/month, depending on scope.

Expertise: Freelancers bring specialization backed with experience from top-tier firms or unicorn startups, offering niche insights defying the bureaucratic mundanity.

The Bright Future of Finance Bros:

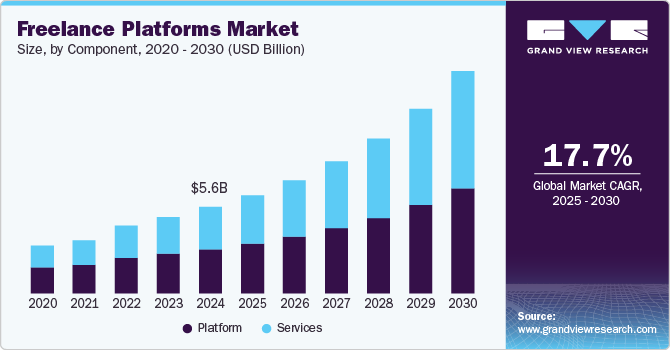

This surge is not some trend that will emerge and settle. It is an uprising, packed with constant evolution, shunning monotonous routines. With global freelancing platforms like Upwork, Toptal, GrowTal, and Indie CAs, businesses today can borderlessly hire top-tier finance professionals. Put together with AI-driven tools like QuickBooks, Zoho Finance, and Fyle, you’re equipped with an intelligent, scalable finance setup that’s ready to deliver a remarkable ovation.

Source: grandviewresearch

However, there’s still a trust threshold. Why? Confidentiality. Many founders hesitate to outsource finance due to concerns around data confidentiality and misalignment around gameplan. But with robust NDAs, readiness around work adoption, and increasing platform credibility, the drawback seems abridged. In the business world, where speed and precision are put coherently to define success, the freelance finance model is not just a backup but rather the walk talk of the town, the standing norm. Whether you’re a bootstrapped students’ startup, a VC founder from the North East, or an NGO in a remote area of Uttar Pradesh, you are not expected to compromise on financial prodigy.

Simulation Role-Play

You’re a startup founder with an MVP, a tired team, and 72 investor rejections. Suddenly — a shot at real funding. But you need a killer deck, a fundraising plan, and financials that don’t scream “Excel crash course”. First option, the traditional consultant — expensive, slow, and full of “let’s circle back”. Second option, a freelance finance pro — fast, startup-savvy, replies with bullet points, not buzzwords, and charges only for actual work. Later one sounds good right! No wonder a 2024 Deloitte India report says 63% of Indian startups prefer freelancers for early-stage finance — all thanks to speed, cost, and sharp expertise.

Struggle Areas: Challenges to the new norm

Initial Skepticism: Trusting becomes difficult

Showing confidence on a random person for such an important task becomes quite uneasy for one and its totally fine. Thoughts like “what if they mess it up or something mischievous turns out?” are normal to arise. That’s the dilemma that every client faces cause just a note that i once helped my cousin puts us in trouble.

Poor Legal Bridge:

Big firms have an entire team of HR that undertakes the responsibility of drafting the documentation, but in freelancing, this becomes one's own responsibility to bring out legal artillery (or at least a canva-designed agreement)

Credibility: The new coins

Buying reviews is the new thing that many individuals do these days. Building trust and credibility is what one demands and can be build with a well maintained linkedin, honest reviews and prior strategy discussion( till some extent) with the client.

Freelancers stepped up. They stopped being just "some guy who knows Excel" and started building real brands around their work. Social proof became a game changer — with portfolios, testimonials, and even well-lit LinkedIn profile pictures playing crucial roles. Clear contracts, confidentiality clauses, and NDAs became standard. Finance freelancers today aren’t just working solo — they’re running one-person firms with as much professionalism as the big guys, minus the mahogany desk and the intern who brings you lukewarm tea.

Balance of two worlds: Hybrid and Micro Agencies

Hiring a full time suit-boot CFO sounds expensive and actually it is. So what do startups do? They go freelance — hiring spreadsheet samurais who can whip up valuation models and investor decks faster than you can say “pre-seed.”

D2C boomtown

Who needs a full-time controller when a freelance finance pro can jump in, clean your cap table, and still have time to post a #WorkFromCafe selfie?

Coworking culture

Spaces like WeWork, 91springboard, Awfis, and IndiQube are buzzing with professionals juggling 3 clients, 2 dashboards, and 1 very strong espresso, all while nestled in a beanbag chair. According to CBRE, India’s flexible workspace supply is set to reach 125 million sq. ft. by 2027

Hybrid Hustle and Micro-Agencies

Big consulting firms now plug in freelancers for niche gigs, teams of 2–5 ex-MBB or Big Four folks are forming boutique micro-agencies — think McKinsey vibes, but in hoodies and Crocs. They bring the polish of consulting with the agility of freelancing: no office politics, no bloated billing, just clean spreadsheets and cleaner strategy. It’s the perfect combo of structure, flexibility, experience, and hustle.

Final Sword: Conclusion

Freelance finance is already mainstream. It’s not just an alternative—it’s becoming the preferred mode. India’s white-collar gig economy is growing at 38% annually, and the freelance finance revolution is riding the wave. Whether you’re building your startup, climbing the corporate ladder, or dreaming of crunching numbers from Bali, freelance finance is the new norm. It’s fast, freelance, and firmly in control of today’s financial narrative.

Referecnces

Bagrecha, A. (n.d.). Outsourced CFO Services in India for foreign companies: Key insights | Jordensky. https://www.jordensky.com/blog/outsourced-cfo-services-in-india-for-foreign-companies-key-insights

Agrawal, A., & Grube, C. (2024, July 18). Toward the long term: CFO perspectives on the future of finance. McKinsey & Company. https://www.mckinsey.com/capabilities/strategy-and-corporate-finance/our-insights/toward-the-long-term-cfo-perspectives-on-the-future-of-finance

building blume ventures one percent - Bing. (n.d.). Bing. https://www.bing.com/search?q=building+blume+ventures+one+percent&form=WNSGPH&qs=SW&cvid=cc11c05f40ef4518a3d86a58766222c4&pq=building+blume+ventures+one+percent&cc=IN&setlang=en-US&PC=HCTS&nclid=067ADD86216226988E4FE938F5BA1C3A&ts=1750059601069&wsso=Moderate

21 of the Best Freelance Memes. (n.d.). https://www.flux-academy.com/blog/21-of-the-best-freelance-memes

India Freelance Platforms Market Size & Outlook, 2030. (2025, May 20). https://www.grandviewresearch.com/horizon/outlook/freelance-platforms-market/india?utm_source=chatgpt.com

ASSOCHAM | Knowledge Architect of India. (n.d.).

https://www.assocham.org/

Nabi, M. (2025, May 5). With 46 pc yearly growth India is the world’s second-largest freelance economy. Media India Group. https://mediaindia.eu/business/with-46-pc-yearly-growth-india-is-the-worlds-second-largest-freelance-economy/?