More on Fin-ovation: the quickly evolving fintech industry

Fintech: your personalized guide to finances!

In part one of tracing the fintech evolution, we delved into its roots from early electronic money transfers in 1918 to modern day transformation of finances overall. There we left off on phase 2 of fintech, which we'll be continuing now. So are you ready to feel it all? Because fintech will care for your finances without giving you a side eye!

PayPal to Pay stack: Fintech’s World Tour

The state of fintech around the globe is like watching a high stake game of jengas, but it’s dollars! Just when you think the structure is steady, some startup pulls a block and there's a new payment app or platform rewriting the rules.

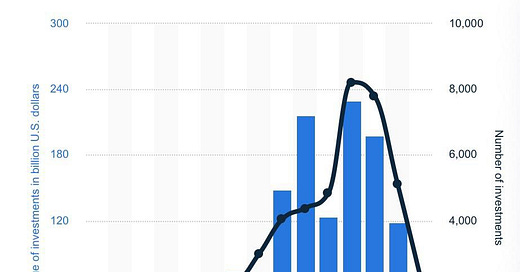

Fintech’s on a world tour, with each region adding its own twist to the innovation party. The US steals the spotlight, snagging half of global investments and dazzling with its tech. But the show doesn’t stop there—Europe, Asia, and Africa are all serving up their unique flavors to the global fintech feast.

USA - Despite fluctuations, the USA remains to be the leading destination for investment, capturing nearly half of the global market. With a whirlwind of AI, Regtech, and open banking innovations, it is pretty evident that the US fintech industry is accelerating. But, like any good movie, it is the villains that keep things interesting. Regulatory challenges and cybersecurity risks continue to lurk in the background. With the “Crypto President”, Trump, back in office, the US fintech market is expecting a shake up, with tax cuts, deregulation and a more crypto- friendly approach.

Europe - Europe’s fintech market, rebounded from COVID with a buzz, tech-savvy population, supportive regulations and a booming venture capital market. While traditional banks scramble to adapt and evolve, fintech startups are seizing market share with agility. Sweden and the UK remain the powerhouses of Europe’s fintech realm, thanks to their mature ecosystems. With the entire continent hitting its stride, European fintech valuations are on track to break the £1 trillion mark.

Africa - Africa’s tech scene is booming, with 10 unicorns—that is 10 times more than there were a decade ago. It’s not just the big names that are leading the charge. M-Pesa, the mobile money service that revolutionised payments in Kenya, continues to play a huge role in financial inclusion. Despite some hurdles, like limited internet access and high data costs, Africa’s youthful and dynamic population is driving innovation. Like the PayPal mafia, Africa is soon expected to have its own technology mafia, founded by Paystack (a Nigerian Fintech company) alumni.

Asia Pacific - Asia Pacific is a digital goldmine, with tech-savvy consumers and lightning-fast digitalisation. While China and India lead the charge in mobile banking and digital lending, Singapore is churning out fintech startups like a startup factory. Government backing, investor buzz, and tech innovation make this region a perfect storm for fintech growth.

Regulatory Technology (RegTech): Who is Policing your Finances?

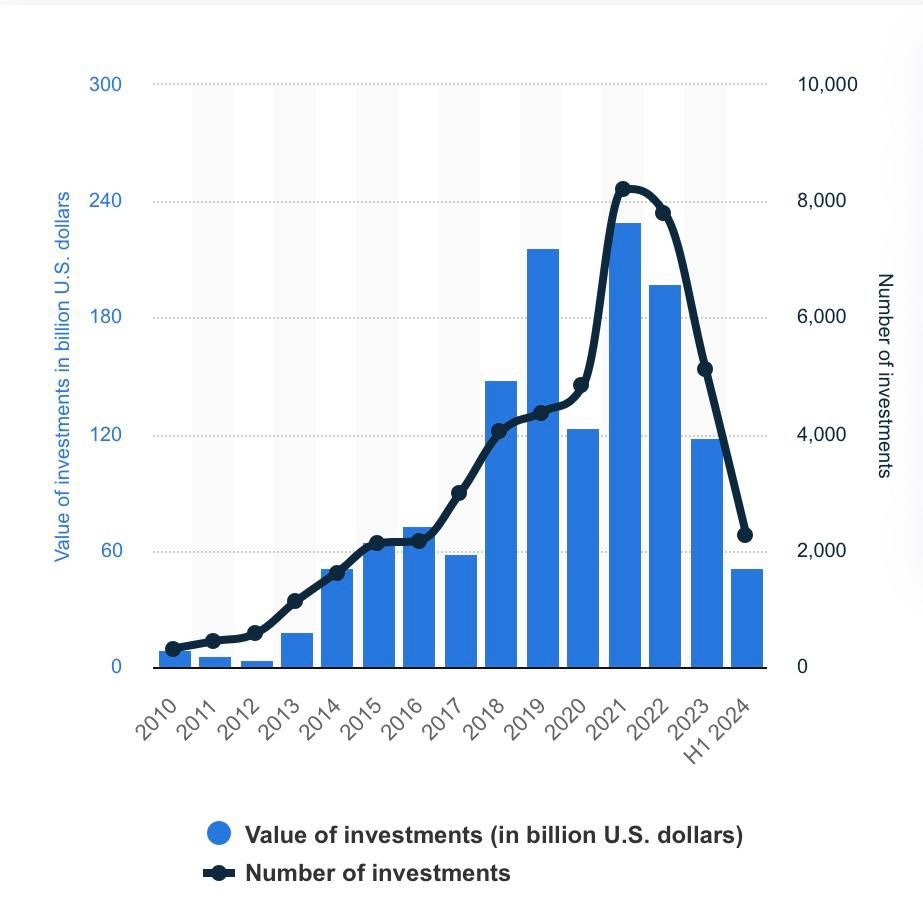

As fintech moves to greener pastures of convenience and technology, cybercrime is on the rise. Banking and financial sector has an estimated loss of 394 billion dollars between 2019 and 2023. Diverse realms within the financial sector such as blockchain, robo-advisors and P2P lending have made regulatory compliance a tough task but fear not- RegTech, our very own FinTech "Batman," is here to save the day.

Short for Regulatory Technology, RegTech leverages AI, machine learning, and cloud computing to streamline regulatory compliance, safeguard data privacy, and enhance risk management.

Our dear friend AI stays on the radar to detect frauds by monitoring deviant transaction patterns and also conducts automated KYC to verify client information. To make sure our secrets stay as they are, cloud computing remains on the front line and ensures data encryption during storage and transfer of data.

The future of secure transactions involves quantum computing to improve encryption and fraud detection and global convergence in regulatory policies. With the emergence of central bank digital currencies (CBCD’s) there can be partnership between financial institutions and central banks to make fintech faster and more secure.

Hyper-Personalization

Personalized ads, personalized Netflix, personalized gifts- why not personalized finance right? It’s time our bank accounts caught up with our streaming platforms. This is hyper personalization in finance- It’s about providing services and products which are tailored to your unique needs. Whether it is investment advice, savings, loan offer or insurance plans, with hyper personalization, you can customize them like your playlist. Finance today isn’t one size fits all; it’s a perfectly tailored suit.

Over 70% of customers value tailored offers from banks, and 56% are willing to share their data for personalized services. This provides banks with opportunities for revenue growth, competitive edge, customer satisfaction, and brand loyalty. The question is, how can banks provide hyper-personalized services? The answer: truly KYC (Know Your Customer). Banks need to hop on AI, machine learning, and cloud computing to stay strong. Fintech is rewriting the rulebook with alternative credit scoring and real-time insights, bringing financial services to the underserved. And with open banking APIs, data flows smoothly for ultra-personalized experiences.

Adopting hyper-personalization isn’t just a trend—it’s a necessity for financial institutions to stay relevant in a customer-first, tech-driven market.

Neo banks: Sit Back and Bank

Who has ever liked standing in long queues at the bank or waiting long hours for payment processing? While online banking has been a game changer, Neobanks with their interactive user interface can be something even better. Neobanks function entirely over the online mode without any physical presence, often using apps as their mode of operation. Also called challenger banks, Neobanks seek to leverage friendly user interfaces and lower costs to provide a comfortable banking experience to young, tech-savvy users.

Not getting sound financial advice? Ask your robo-advisor to guide you, not just this, neo banks also offer perks like lounge access, free money transfers and payments and cryptocurrency trading. Moving into the future, neo-banks can make international payments much faster and even support your entrepreneurial journey by securing funds for your dream project through peer to peer lending!

Banking sector’s dilemma right now: complicated financial and banking matters can get boring sometimes, so how can we make it more interesting for gen Z? Entering from behind the curtain: gamification.

Gamification: Level up your financial game

Ever played Subway Surfers to collect more coins or beat your high score? Now, you can apply the same motivation to enhance your savings and investments, courtesy to the gamification of financial apps. Gamification primarily involves a fusion of game-like features such as levels, badges, and leaderboards into the user interface to encourage smarter financial behavior. Such behavior might include saving more to earn a reward or Leading the leaderboard with the best investment gains.

Now, it's not just your parents but your finance apps that will encourage you to eat out less and save more. However, be cautious: while earning scratch cards is satisfying, it's not worth the increased expenditure.

The Buzz Behind Revolut’s Global Impact

Fin-fluencer: In this era, where my grandfather asked me to let him know when I receive the ‘shagun’ he sent me through UPI (by sending a thumbs up emoji on Whatsapp, ofc), I must admit fintech is no less than a talk of the town influencer, or should I say, “fin-fluencer”.

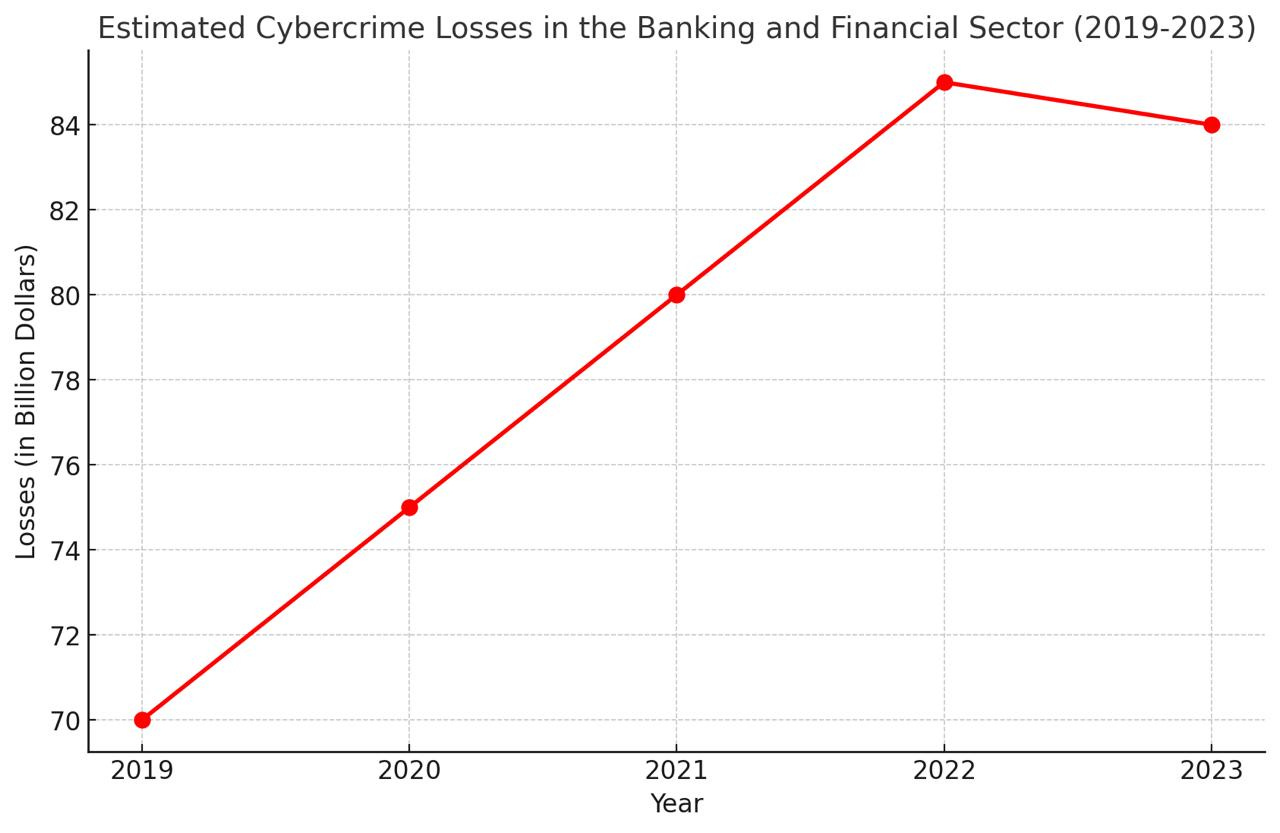

Amidst all these, today we will talk about the cool kid of fintech, Revolut! As Revolut itself puts it, ‘whether it’s Morocco or Mexico, you can transfer there — really, really fast. Oh, and the rates are as good as you’ve heard.’

Founded in 2015 by Nikolay Storonsky and Vlad Yatsenko, Revolut is a $5.5 billion UK-based fintech that’s shaking up banking without branches. By going the neo bank route, it slashes costs and passes the savings to users. Offering everything from banking and currency exchange to crypto trading and BNPL, Revolut’s got the modern wallet covered—all with low fees and a banking license.

Plans for expansion in India:

Nikolay Storonsky called India, one of the most advanced markets. With the simplest idea of making finance manageable, Revolut saw India as a ripe market for consolidation and aimed to enter the Indian landscape in 2021. It was a good ground for its disruption spree, even though players like Paytm, Razorpay, PhonePe and stock broking apps like Groww dominate the digital payments space in the country. Having worked with RBI for over two years now, it is all geared up to issue Prepaid Payment Instruments (PPI) including prepaid cards and prepaid wallets in the country as it received an in-principal authorization from RBI this year. Putting it straight, it will allow it to function as a domestic operator in India now. With this, India stands as the only market where the platform is offering a localized version of the app.

The Secret Sauce!

The ‘can’t tell you, won’t tell you’ recipe you ask, is the extremely low fee transfers. With a few quick taps, your money travels without those abysmal rates. The wanderer in you would love how it dismantles the old high cost approach and the sluggish transfers. Another yet revolutionary move is its early disruption in the crypto market. It allowed all the crypto-curious beginners to test the waters of this vast ocean.

Yet, the best part?

As they say, Dare to Disrupt; it has literally kept the traditional financial institutions on its toes. Revolut has not just reshaped consumer habits but also pushed financial systems already prevailing in the market to catch up, with the efficiency, the user-friendly interface for the quick tech-savvy user base and to rethink their hefty fee structures, basically creating a ripple effect. So, should we say it just fin-fluenced the money management for the modern age?

Conclusion

The world of fintech is evolving like that person in a rom-com who keeps a record of your tiniest of details. The hyper-personalization will soon remember your regular McD order. From the rise of neo banks to AI interrupting fraud detection, the industry just keeps getting better at tailoring your finance management. Low-fee international transfers and a chance for crypto dabbling, help these industries maintain their A-game. Looking ahead, the future is all about security betterment, more personalization (who knows me better with a twist) and possibly, gamified savings accounts where you earn badges for budgeting.

To conclude, fintech is not just waves, it's a tsunami.

References:

Corander, B. (2021). Neobanks: Challenges, Risks and opportunities. Theseus. https://www.theseus.fi/handle/10024/498077

ET Government & www.ETGovernment.com. (2024b, April 13). Revolut gets in-principle approval from RBI for Prepaid Payment Instruments licence. ETGovernment.com. https://government.economictimes.indiatimes.com/news/digital-payments/revolut-gets-in-principle-approval-from-rbi-for-prepaid-payment-instruments-licence/109272805

Fintech in Africa: The end of the beginning. (2022). In McKinsey & Company. https://www.mckinsey.com/industries/financial-services/our-insights/fintech-in-africa-the-end-of-the-beginning

Ganbold, S. (2024, May 15). Fintech in the Asia-Pacific region - statistics & facts. Statista. https://www.statista.com/topics/7970/fintech-in-asia-pacific

Hyper-personalization - WiPro. (n.d.). https://www.wipro.com/banking/hyper-personalization/

Obeng, N. S., Iyelolu, N. T. V., Akinsulire, N. a. A., & Idemudia, N. C. (2024). The Transformative Impact of Financial Technology (FINTECH) on regulatory compliance in the banking sector. World Journal of Advanced Research and Reviews, 23(1), 2008–2018. https://doi.org/10.30574/wjarr.2024.23.1.2184

PricewaterhouseCoopers. (n.d.). RegTech: A new disruption in the financial services space.PwC.https://www.pwc.in/industries/financial-services/fintech/fintech-insights/regtech-a-new-disruption-in-the-financial-services-space.html

Shanti, R., Siregar, H., Zulbainarni, N., & Tony, N. (2024). Revolutionizing Banking: Neobanks’ digital transformation for Enhanced efficiency. Journal of Risk and Financial Management, 17(5), 188. https://doi.org/10.3390/jrfm17050188

Statista. (2024, September 9). Investment activity in fintech globally 2010-2024. https://www.statista.com/statistics/719385/investments-into-fintech-companies-globally/

Great work 👏

Great🫶🏻