In the beginning…

The story of India's pharmaceutical sector is one of impact, innovation, and ambition. It all started in 1970 with the Patent Act, a law that made it possible for India to manufacture reasonably priced generic medications, transforming the nation into a center for high-quality, reasonably priced medications. Over the years, the sector has expanded into a $50 billion+ behemoth that supplies 20% of the world's generics and more than 60% of its vaccines.

But this is a lifeline, not just an enterprise. India's pharmaceutical industry has demonstrated its ability to grow, innovate, and take the lead in combating pandemics, providing life-saving vaccines, and enabling the poorest people to receive therapies. Its journey—from the generics revolution to vaccine diplomacy—is evidence of what occurs when a country chooses to cure the world as well as itself.

Indian Pharma: From Pandemic Crisis to Global Vaccine Leader

India, often dubbed the ‘Pharmacy of the World,’ came into the spotlight owing to the COVID-19 pandemic. Initially, Vaccine manufacturing was hampered by supply chain constraints and reliance on China for 70% of Active Pharmaceutical Ingredients (APIs). The crisis revealed weaknesses in India's pharmaceutical ecosystem, prompting policy measures to enhance self-reliance.

The pandemic put India's healthcare system to a severe test as individuals struggled for oxygen cylinders on hospital beds throughout the nation. Black markets boomed, and vital drugs such as demand for life-saving medications like Remdesivir vials were sold at ten times their original price. The Government of India therefore rolled out a ₹13.76 billion incentive package in order to speed up API production and break the foreign dependence. The Production Linked Incentive (PLI) scheme and initiatives such as Hyderabad Pharma City are directed towards establishing India as a world pharmaceutical manufacturing hub.

Source: Press Information Bureau

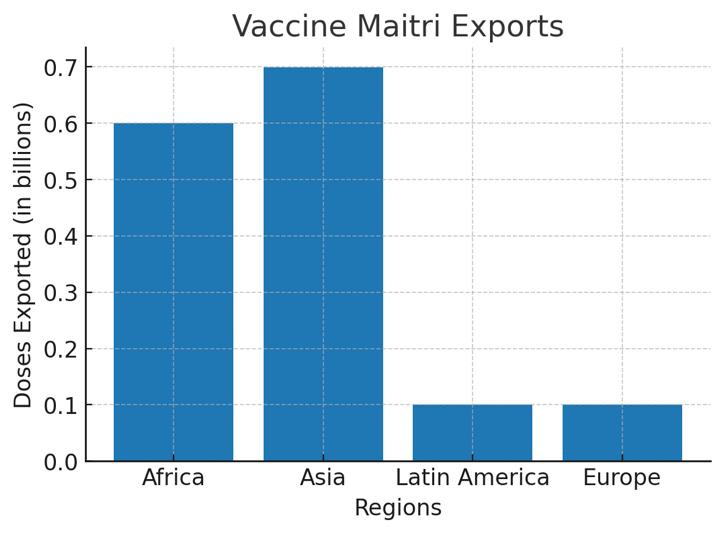

In the midst of these difficulties, India also took the lead in vaccine manufacturing. Bharat Biotech's Covaxin and Covishield by Serum Institute formed the backbone of Vaccine Maitri, India's international effort that shipped out vaccines to 165+ nations, both furthering humanitarian reach and diplomatic relations.

Serum Institute: The Vaccine Giant with a Heart

Imagine a world where life-saving vaccines are a luxury only a few can afford. Now, meet Serum Institute of India (SII)—the quiet giant that said, “Not on my watch.” From the dusty streets of Pune to the farthest corners of the globe, Serum has been delivering hope in the form of affordable vaccines for decades. But Serum isn’t just about numbers—it’s about people. It’s about the mother in rural Africa who can finally breathe easy knowing her child is safe, or the healthcare worker in India who sees a ray of hope in every vial. Behind every dose is a story of resilience, innovation, and humanity. Let’s dive into the numbers that make Serum’s mission possible—and the challenges it must overcome to keep saving lives.

1. The Undisputed Vaccine Champion

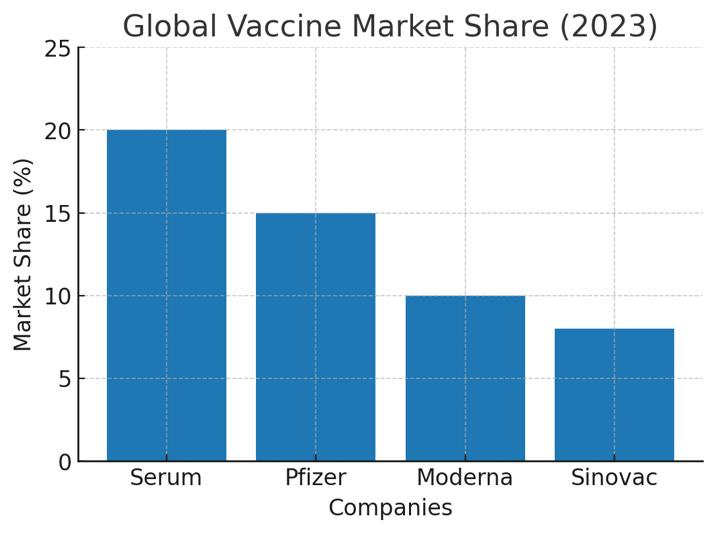

The Serum Institute dominates the arena of the global vaccine market. To put it crudely, it is the clear-cut winner of the game considering that they have revenue driven from profits between 10 billion USD to 15 billion USD. With a whopping 20% market share, it’s the largest vaccine manufacturer by a ‘lands end’ with sky-high revenues and even higher Pfizer and Moderna combined earnings.

Source-Self generated

2. Cha-Ching! Revenue on a Mission

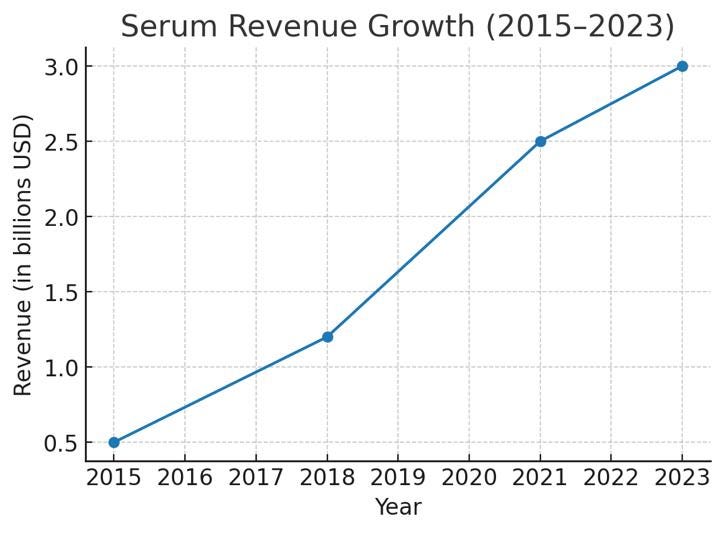

Serum’s growth is akin to a rocket. These figures have surged with an astonishing CAGR of 15% for the past decade, hitting a significant milestone of $3 billion in 2023. Serum’s growth, fueled by COVID-19 gains, stems from decades of saving lives—one vaccine at a time.

Source-Self generated

3. COVID-19 Heroics: Covishield to the Rescue

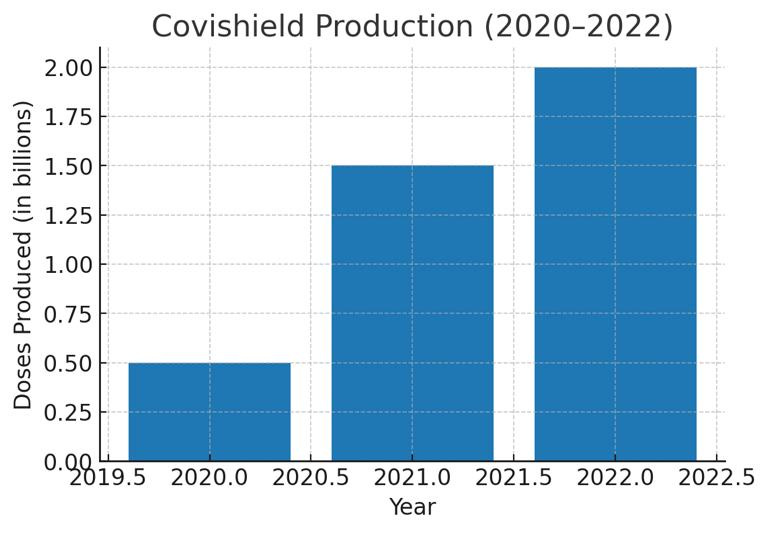

With the world on the brink of a panic, Serum made a mark by rolling its business into overdrive with an unprecedented rate of 2 billion doses of Covishield getting injected in masses, allowing it to be the supplier for mega COVID-19 vaccines.

Source-Self generated

4. Vaccine Diplomacy

The Friendly Neighborhood Pharmacist of the World, Serum didn't merely manufacture vaccines; it exported them to more than 150 countries via its Vaccine Maitri initiative. As a result, Serum evolved into the world’s friendliest pharmacist.

Source-Self generated

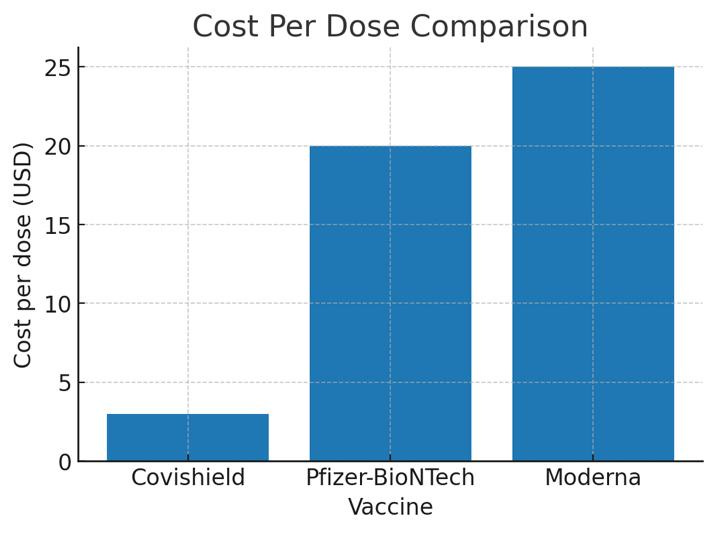

5. Affordable Vaccines

Because Staying Healthy Shouldn’t Require Unpayable Expenses Serum decided to price its lifesaving vaccine, Covishield, at a mere ‘3 USD,’ far below the 20-25 USD doses charged by Pfizer and Moderna.

Source-Self generated

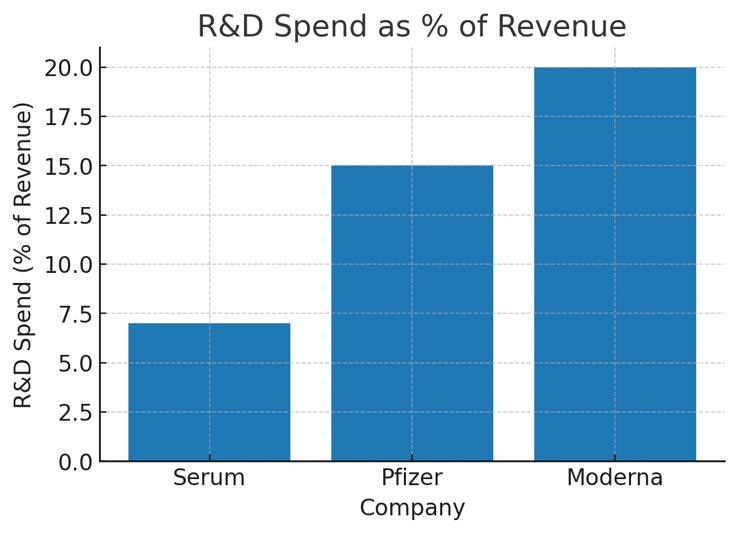

6. The Innovation Gap

Surprising isn't it? Serum only spends around 7% of revenue on R&D, in comparison to Pfizer and Modena who normally spend around 15%-20%. Rather than being showered in all the newest technology, Serum is a boondoggle in a world of flip phones. In order to innovate, Serum should consider increasing their spending on R&D.

Source-Self generated

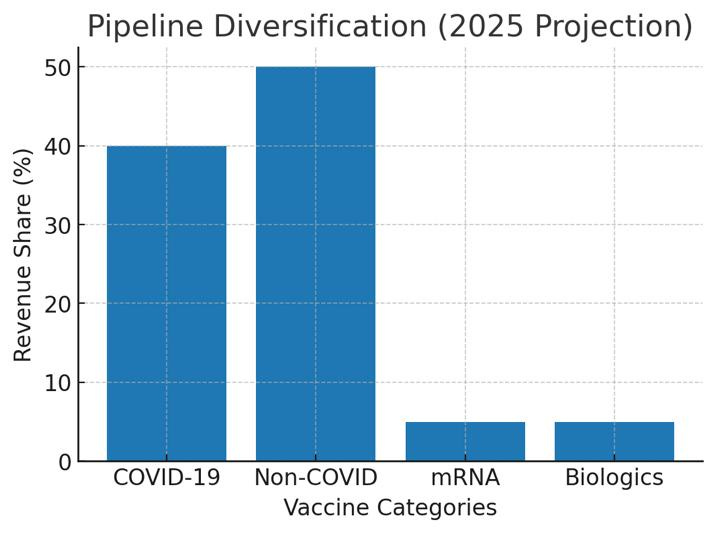

7. Pipeline Diversification: Going Beyond COVID-19

Serum is aware that the COVID wave won't last forever. With significant investments in mRNA and biologics, it intends to make non-COVID vaccines 50% of its sales by 2025.

Source-Self generated

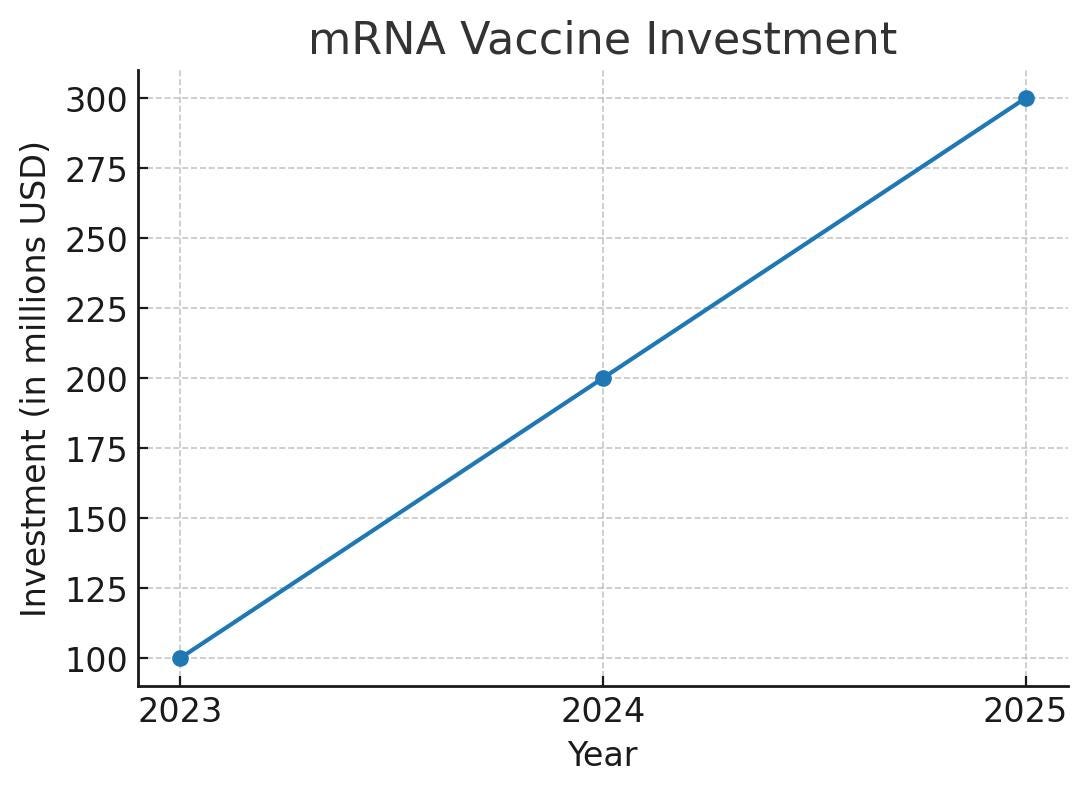

8. Placing a Bet on the Future

mRNA Vaccines Serum isn't merely counting its lucky stars. It’s investing $300 million in mRNA vaccines by 2025. Move over, Pfizer and Moderna—there’s a new player in the mRNA game, and it’s playing for keeps.

Source-Self generated

From Generics to Giants

In the global healthcare arena, India's pharmaceutical sector is now the overachiever rather than the underdog. With a market value of $65 billion and a compound annual growth rate (CAGR) of 9%, it is outpacing your grandmother's secret home remedies. In terms of revenue, Sun Pharma leads the sector with ₹28,905 crores and is the front-runner in the generics and specialty drugs industry. Dr. Reddy's, with similar revenue figures, has a significant share in biosimilars and U.S. generics, while Cipla, with revenue of ₹26,521 crores, focuses on respiratory and antiretroviral medicines. The Serum Institute of India, the leading vaccine producer in the world, provides more than sixty percent of vaccines worldwide, thus contributing substantially to immunization. These companies, along with having the most U.S. FDA compliant plants outside the U.S., are further aided by domestic policies such as the PLI Scheme which encourages self-dependence, ensuring that India remains a leader in pharmaceuticals and healthcare innovation.

Source- Brickwork Ratings

With everything being said, drug discovery speeds move just marginally quicker than your internet on a rainy day. Artificial Intelligence, on the other hand, is fractionally faster at finding potential drug candidates than the time it takes to mention a clinical trial. In India, when talking about AI, the chance of it just computing figures is slim to none, rather it is optimizing the manufacturing and distribution process of vaccines to ensure people don’t have to deal with the inefficiency of making sure everyone gets the jab. Companies seem to be automating everything these days with AI, from basic research to quality assurance utilizing computer vision. AI predictive modeling has also been implemented to improve production process optimization, waste reduction, and consistency.

Even superheroes have it bad some days and for India, it's the endless price wars, red tape, and the never-ending thirst for more funding in research and development. Nevertheless, with innovation driven by AI and pharmaceutical giants accelerating, India’s title as “The Pharmacy of the World” is only getting sharper and more advanced.

The pharmaceutical industry has been a lifeline for humanity, curing diseases, eradicating pandemics, and extending lives. But behind these triumphs lies a shadow—a story of greed, negligence, and lives lost to the very drugs meant to heal.

The pharma sector’s triumphs are undeniable, but its failures are equally stark. For every Serum Institute uplifting global health, there’s a Purdue Pharma leaving a trail of devastation.

Pain and Pills- Opioid Crisis

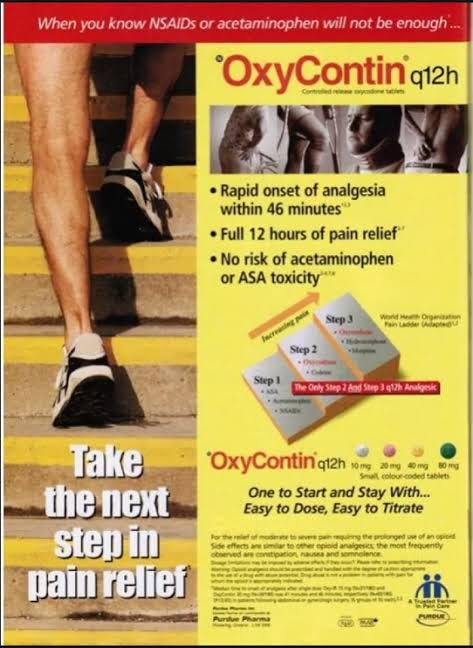

In the pharmaceutical sector, there is a common saying, “more infections, more money”. While some companies treat it as it is, a dark joke, others are rather cynical. Such is the case of Purdue Pharma, the creator of OxyContin, “one to start and stay with” drug. Purdue Pharma with its blockbuster drug was the leading supplier of prescription opioids to patients. The pharma had such remarkable leadership that it led to an epidemic in the US, killing over 500,000, tearing families and burdening the US economy with over a $1 trillion in healthcare and productivity costs. For Purdue however, this was a small cost to pay for the billions it earned in profits.

The roots of the crisis can be traced back to the late 1990s, when pharma companies began marketing prescription opioids as safe, non-addictive, 12 hours of pain relief- easy to dose painkillers. While there were other players, the protagonist or the antagonist was Purdue. The pharma company paid “thought leaders” in medicine to promote the use of prescription opioids and also paid large sums to physicians to endorse OxyContin. They aggressively promoted the drug as non-addictive due to its slow release properties and addictive only for people with “addictive personalities”. At its prime Purdue hosted over 3,000 doctors for an all-expenses-paid conference, where they touted OxyContin for a wide variety of conditions, ranging from back pain to arthritis.

Source-CBC

The blame game however was far from over, because advising the Pharma was none other than the consulting giant notorious for having questionable clients, McKinsey. The prestigious consulting firm, for nearly 15 years, didn’t just advise Purdue Pharma on how to sell painkillers- they practically handed them a playbook with sales tactics that could turn even a mild cold into a high-stakes addiction. Even after the opioid epidemic was declared a public health crisis, the firm created a roadmap for companies like Purdue to follow to “turbocharge” the sales. They recommended companies to target the communities already hit by opioids and suggested that Pharma Company offer managers a rebate of thousands of dollars, for each overdose caused by the pills and cash price and perks to salesmen to boost sales.

If hypocrisy was a game, McKinsey would bag a gold medal. While advising Purdue on how to aggressively boost sales, it was simultaneously working with FDA (the Government) to improve drug safety. Two faced much? It was also found that 22 McKinsey employees were working for both the FDA and Purdue Pharma at the exact same time. They somehow managed to play both Purdue’s cheerleader and FDA’s advocate, while cashing cheques from both ends.

After continuously adding fuel to the fire, for years, the consulting powerhouse issued a public apology, the corporate equivalent of ‘Oops, I did it again’. The firm at last agreed to pay nearly $600 Million as a nationwide settlement i.e. hush money. And of course, Purdue Pharma ended up paying billions of dollars in settlement. However the question remains, is this enough?

Conclusion

India's pharma sector is ready to achieve staggering growth, with estimates predicting that it will be $130 billion by 2030. The growth is being driven by an emerging AI revolution, which is revolutionizing drug discovery and process efficiency, enabling processes to become faster, more affordable, and more accurate. In order to take advantage of this trend, strategic investment in research and development (R&D) and large-scale implementation of AI technologies is essential. By concentrating on innovation and building on its current strengths as the "pharmacy of the world," India is poised to cement its position as a global healthcare leader. With a combination of advanced technology and strategic vision, India can not only lead economic growth but also effectively address global health issues, positioning itself at the vanguard of the pharmaceutical and biotech sectors.

References and Citations

1) McKinsey Reaches Agreements with 49 State Attorneys General to Resolve Investigations into Past Work for Opioid Manufacturers. (2021, February 4). McKinsey & Company.

https://www.mckinsey.com/de/news/presse/settlement-funds

2) Becerra, X., Akers, N., Fiorentini, J., Burkart, M., SBN 234121, Lundgren, T., SBN 254596, SBN 294405, Kane, K., SBN 291828, People of the State of California, & McKinsey & Company, Inc., United States. (2019).

3)Opioid settlements. (n.d.). New York State Attorney General.

https://ag.ny.gov/nys-opioid-settlement

4) Oversight Committee Democrats. (2022, April 27). McKinsey & Company’s conduct and conflicts at the heart of the opioid epidemic [Video]. YouTube.

5) Covid-19 impact on Indian pharmaceutical industry. (n.d.). https://www.pharmabiz.com/ArticleDetails.aspx?aid=135427&sid=9

6) Singh, B., Singh, S., Singh, B., & Chattu, V. K. (2022). India’s neighbourhood vaccine diplomacy during COVID-19 pandemic: Humanitarian and geopolitical perspectives. Journal of Asian and African Studies, 58(6), 1021–1037. https://doi.org/10.1177/00219096221079310

7) Kimta, A., & Dogra, R. (2024). Artificial intelligence in the pharmaceutical sector of India: future prospects and challenges. Research Square (Research Square). https://doi.org/10.21203/rs.3.rs-3878145/v1

8) Sharun, K., & Dhama, K. (2021). India’s role in COVID-19 vaccine diplomacy. Journal of Travel Medicine, 28(7). https://doi.org/10.1093/jtm/taab064

9) Rating Rationale. (n.d.). https://www.crisilratings.com/mnt/winshare/Ratings/RatingList/RatingDocs/SerumInstituteofIndiaPrivateLimited_March%2007_%202024_RR_337397.html

10) Sharon, M. (2013, March 18). Serum Institute targets 18% growth. www.business-standard.com. https://www.business-standard.com/amp/article/economy-policy/serum-institute-targets-18-growth-104031101105_1.html

11) Somasundaram, V., Soukas, P., Patel, J., & Ferguson, S. (2021). Considerations for potential Global expansion of Serum Institute of India. Journal of Commercial Biotechnology, 26(4). https://doi.org/10.5912/jcb1006